As one of the top homebuilders in Oklahoma, we have helped thousands of Oklahomans find their dream home. We believe in building beautiful homes that have the latest safety and energy efficient features!

We are bringing over 40 years of homebuilding experience to Texas! Let us help you find your new home in the Houston metro!

An energy efficient home is not only good for the environment, but saves homeowners on monthly bills. A Home Creations home is over 60% more energy efficient than typical existing homes.

Learn More

Home safety starts with what’s built behind the walls. From fire safety to water safety; we believe in setting the standard for building safe homes in Oklahoma.

Learn More

We add several features, with the latest technology, to make life easier for you and your family. Some of these features, such as Kwikset Smartkey locks and smart thermostats, allow you to control your home from your smart phone.

Learn More

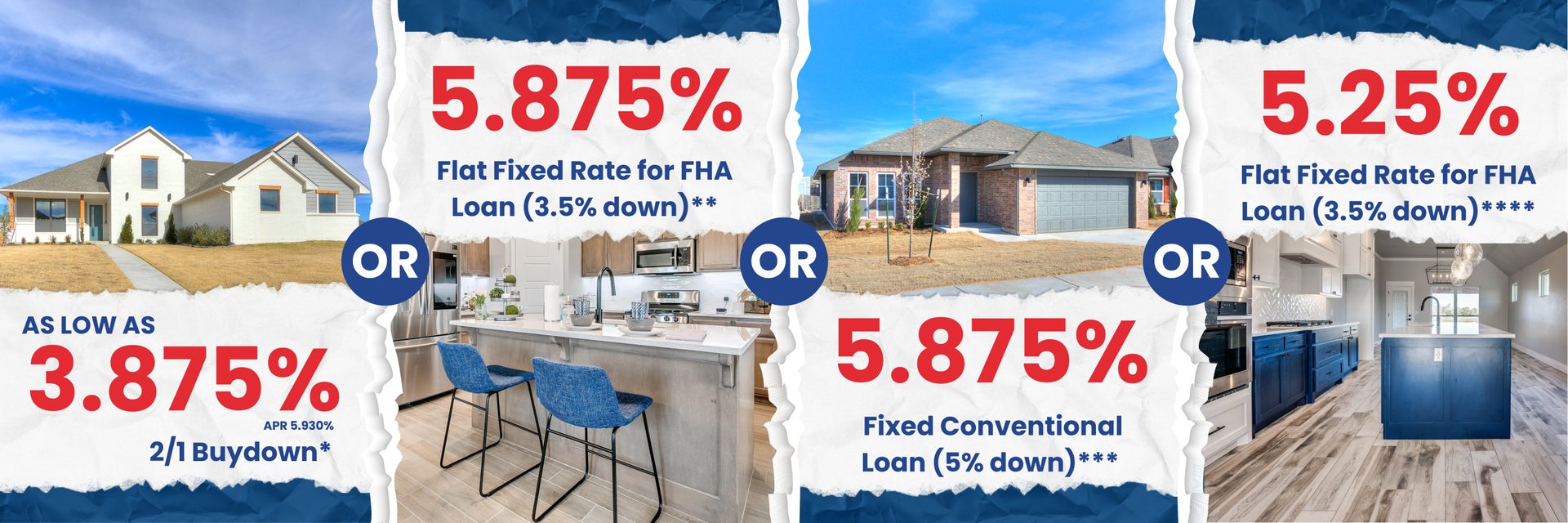

We, along with our participating lenders, have helped thousands of Oklahoma homeowners through the financing process, while offering an array of loan programs that fit the unique needs of each homebuyer. We are able to save homebuyers money at closing because of the seamless process with these lenders. In fact, you can save up to $2,500 in closing costs if you finance the purchase of one of our homes with one of our participating lenders (Oklahoma City market only).